Another holiday is in the rearview mirror, so for retailers it’s time to assess how everything went — and how those findings will inform plans for 2022. Our look at some key metrics from the last six weeks explores some defining characteristics of the 2021 peak season for eCommerce and B2B retailers, as well as what they mean for the year ahead.

How Was the 2021 Peak Season for eCommerce Different to 2020?

As the first holiday season impacted by the pandemic approached, we took a look at 3 Ways the 2020 Peak Season is Different to Any Other. How did those differences play out and did they hold true for 2021 as well?

For starters, consumers continued to shop early. Retailers understood the value of spreading demand into October, as Amazon achieved with an October Prime Day event in 2020. Many brands planned promotions well in advance of Black Friday. This trend was accelerated by supply chain uncertainty hanging over the holiday, with ongoing delays at crucial hubs like the Port of Los Angeles/Long Beach. Some shoppers got in early to avoid disappointment, as industry observers had recommended for months.

A notable change was the return of confidence towards in-store shopping, at least during the initial part of the holidays before the Omicron variant surged in December. With vaccinations and booster shots tipping the balance back towards in-person activity for much of the second half of the year, consumers were emboldened to return to stores in a way that they could not the year before. Even so, there can be little doubt that rising case numbers throughout December and supply chain delays impacting availability stymied some of that trend back to bricks and mortar retail.

With those similarities and differences in mind, let’s examine some key statistics that define the 2021 peak season.

Watch the video above to see how we deliver delight during peak season.

7 Stats That Explain the 2021 Peak Season for eCommerce

With the context of recent holiday seasons set, here are some of the reports and metrics that we feel tell the story of the 2021 peak season for eCommerce.

1. 256% increase in out-of-stock messages in 2021 vs. 2019 (Adobe, via DigiCommerce 360)

More than two-thirds of shoppers experienced some kind of out-of-stock notification during the 2021 peak season for eCommerce, driving many to seek out competing sites and products, or head to physical stores to find an alternative. While Adobe’s findings represented a huge surge compared to pre-pandemic levels, out-of-stock notes increased only 10% over 2020 indicating a new concern that seems unlikely to recede in 2022.

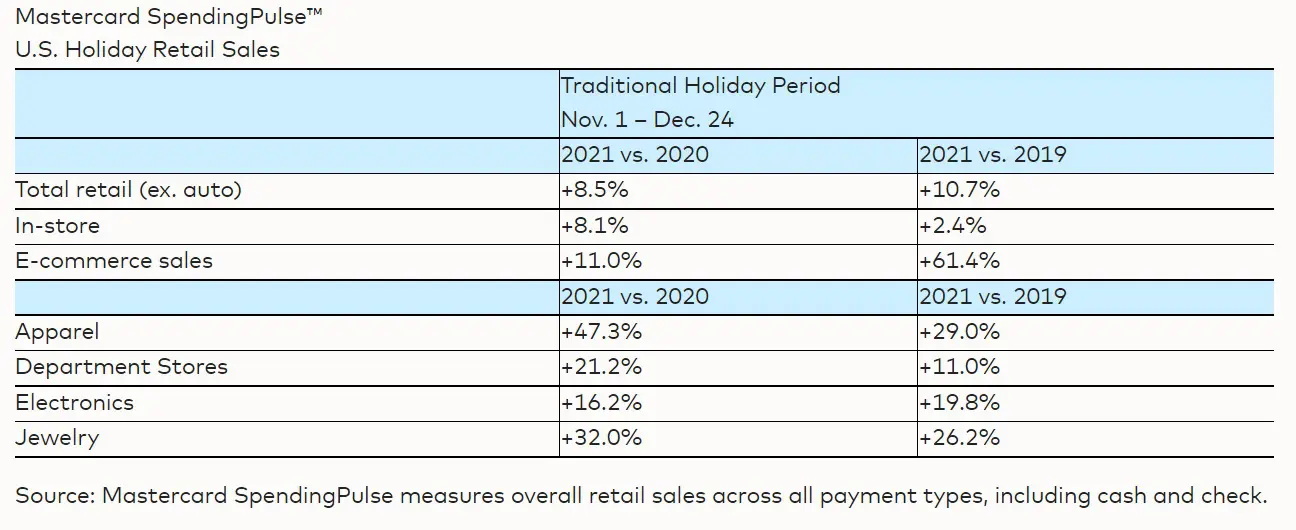

2. eCommerce sales in 2021 represent a 61% increase over pre-pandemic levels (Mastercard)

Mastercard’s report for holiday purchases in 2021 puts spending up across the board, with total sales jumping 8.5% over the 2020 season and eCommerce sales surging to 61% above pre-pandemic levels. Sandwiched between stats showing the logistics challenges faced by brands over the past two years, it becomes clear that supply chain considerations remain the limiting factor for peak season preparation.

3. 24% fewer “back in stock” emails sent in 2021 holiday sales vs. 2020 (Klaviyo)

Supply chain bottlenecks took hold throughout 2021 and manifested most significantly during the crucial Q4 period. With resulting declines in product inventory and decreased ability to get popular items either onto shelves or into the hands of customers. Sales forecasts proved optimistic even as eCommerce demand continued to grow, leaving retailers to reassess inventory strategies heading into 2022.

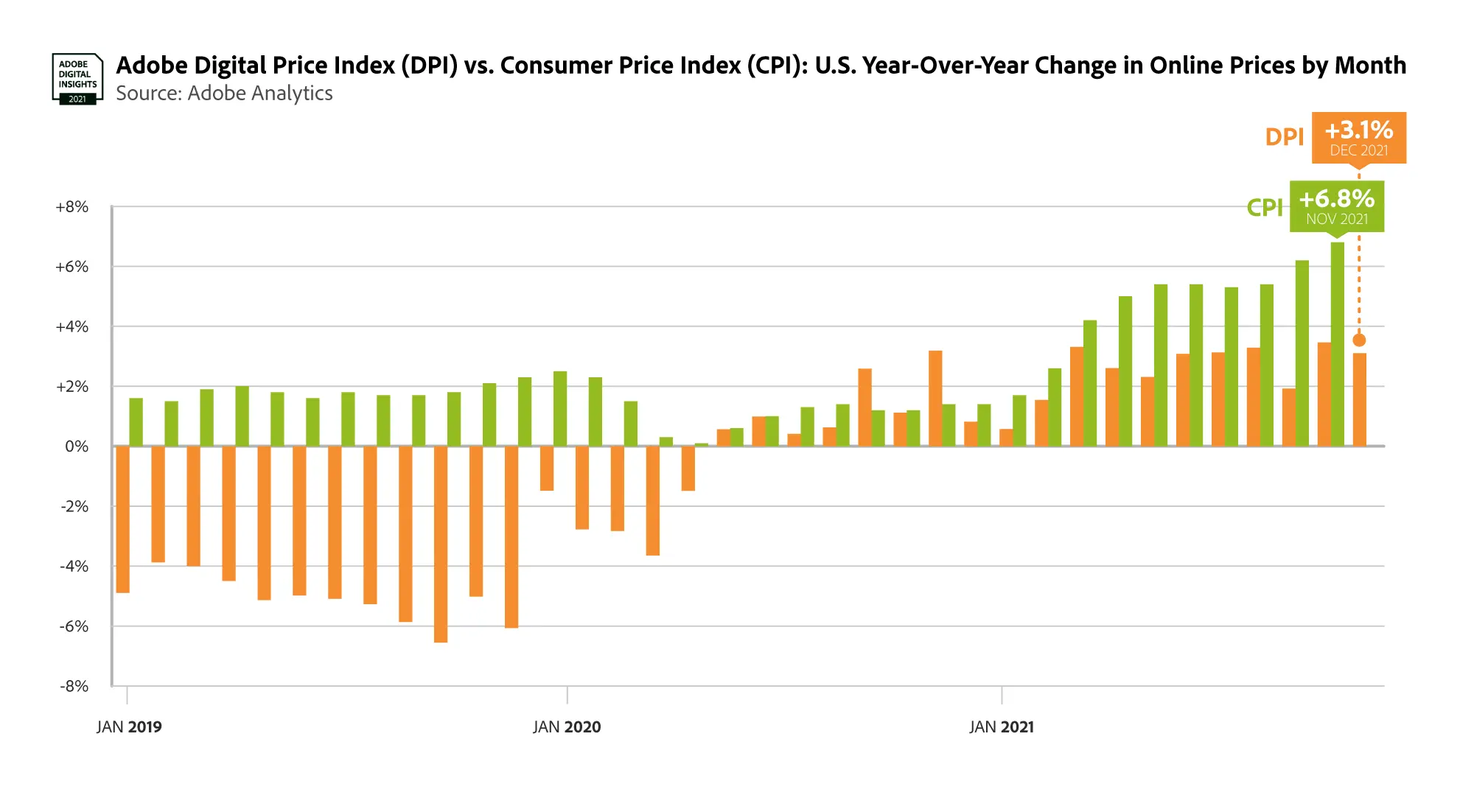

4. 19 consecutive months of year over year inflation online, punctuated by 3.1% in Dec. 2021 (Adobe Digital Price Index)

Wider economic concerns around rising prices could not be offset by the rush to holiday discounts, as 3.1% online increases in December alone emphasized the ongoing challenge of inflation. Combined with the inventory challenges limiting the availability of popular items, consumers and retailers alike acknowledged generally weaker online discounts during the 2021 peak season for eCommerce.

5. 10x increase in promotional text messages in 2021 vs. 2020 (Klaviyo)

As retailers sought to amplify their promotions earlier and wider in 2021, more than 132 million text messages were sent to customers. This tenfold rise over the previous year demonstrates an increased desire to reach customers “on the go” and embrace promotional avenues that many have previously overlooked in favor of email and social media. In 2022, expect retailers to integrate all of these channels into more cohesive omnichannel experiences, from research and identification to sales support and customer service.

6. 5% online vs. 16.5% in-store sales increase shows Black Friday/Cyber Weekend remains important for eComm, critical for physical retail (Mastercard)

Although eCommerce and in-store sales are increasingly two sides of the same coin for retailers occupying both spaces, the importance of key shopping dates like Black Friday and the following “Cyber” Weekend play an outsized role for in-person shopping. Digital-first consumers chose to shop earlier as a solution to anticipated product shortages and rising prices, where as those who prefer stores showed greater inclination (16.5% increase YOY) to uphold seasonal tradition and brave the holiday crowds to seek out their discounts.

7. UPS and US Postal Service maintain 96%+ on-time deliveries, while FedEx lags behind (ShipMatrix.com)

Data from parcel analytics firm ShipMatrix highlighted UPS and USPS as top performers in the carrier category during the 2021 peak season for eCommerce, with highs of 96.4% on-time deliveries for UPS and 96.1% for the Postal Service in the weeks of and following Thanksgiving. FedEx could only achieve 87.9% in that same period, although it recovered somewhat with on-time performance of 91.2% in the weeks leading up to Christmas. Most carriers reported lower strains than usual on their delivery networks, thanks in part to consumers starting their shopping earlier and more in-store shopping in 2021, compared to the previous year.

In short, consumer demand was robust both in-store and online throughout the 2021 holiday season, despite weaker discounts, supply chain headwinds, and pandemic uncertainty.

The 2021 peak season for eCommerce and B2B retailers yielded a curious blend of challenging conditions and cause for optimism. If similar consumer behavior evolves in 2022, the primary challenge for retailers will be to continue developing their omnichannel approach while resolving supply chain bottlenecks that threaten to undermine broader customer experience initiatives.